The struggle is real.

Student loan debt related stress is harmful to employees (and employers) according to the American Institute of Health.

It takes a toll on the physical and mental wellbeing for the troops on the ground showing up to work towards your company’s mission every day.

Stress leads to apathy. Disengaged workers not achieving their potential and reducing productivity at work.

30% to 80% of employees waste time at work dealing with personal financial matters which contributes to lost productivity and lower engagement.

Wrap your head around that for a minute.

The average worker spends 16 hours a month dealing with personal financial matters while AT WORK!

Stress in the workplace

In the United States, a staggering 52% of Generation Z have been diagnosed with mental health issues reported by Everyday Health.

In the same report from 2018 linked above, 44% of Millennials and Gen Z cite that work was a regular cause of stress and less than half of these employees are talking to you about it.

Why is that? According to the ADAA 34% of workers don’t feel safe reporting stress because of the negative implications classifying them as unwilling, disinterested, and weak which could affect promotion opportunities.

Stress is bidirectional and flows back and forth between work-life and personal life.

Financial Debt is Killing The American Dream

The college educated workforce is getting schooled on student loans.

“Too much debt” is this GenY/Z’s #1 financial stressor with student loans as their second-most stressful form of debt.

This all started back in 2008 during the last Great Recession.

Look at the data. US Department of Education reported a year over year increase in loan defaults were up 20% between 2007 and 2008.

Unemployment rates soared in 2008 causing a spike in college enrollment for two main reasons:

- To acquire new skills/certifications that could make them more likely to land a job.

- Students ‘waiting out’ the downturn effectively redshirting themselves for a better job market in the future.

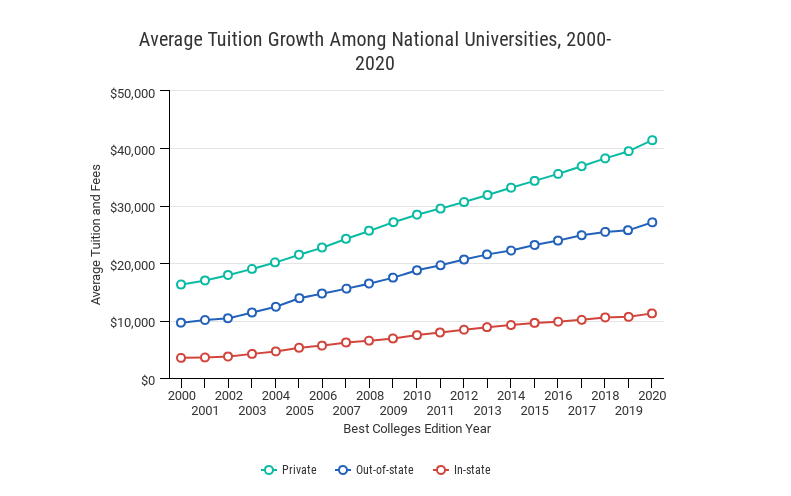

Tuition costs soared and our government federalized student loans which left 7 out of 10 graduates in debt as reported by Guardian’s Workplace Benefits Survey

The economic house of cards started falling.

From 2005 – 2014 Millennials (ages 24-32 during this home period) stopped buying houses.

The Fed reported that for every $1,000 in debt, a 1%-2% drop was expected for home ownership.

Education debt negatively impacts the borrower’s credit. Lower credit scores make it harder to qualify for home loans.

Even if they could get approved, a mortgage payment + loan payment put the lower wage earning recent grads into a cash strapped position.

For this cohort with an average of $30,000 in student loan debt, purchasing a home was out of reach.

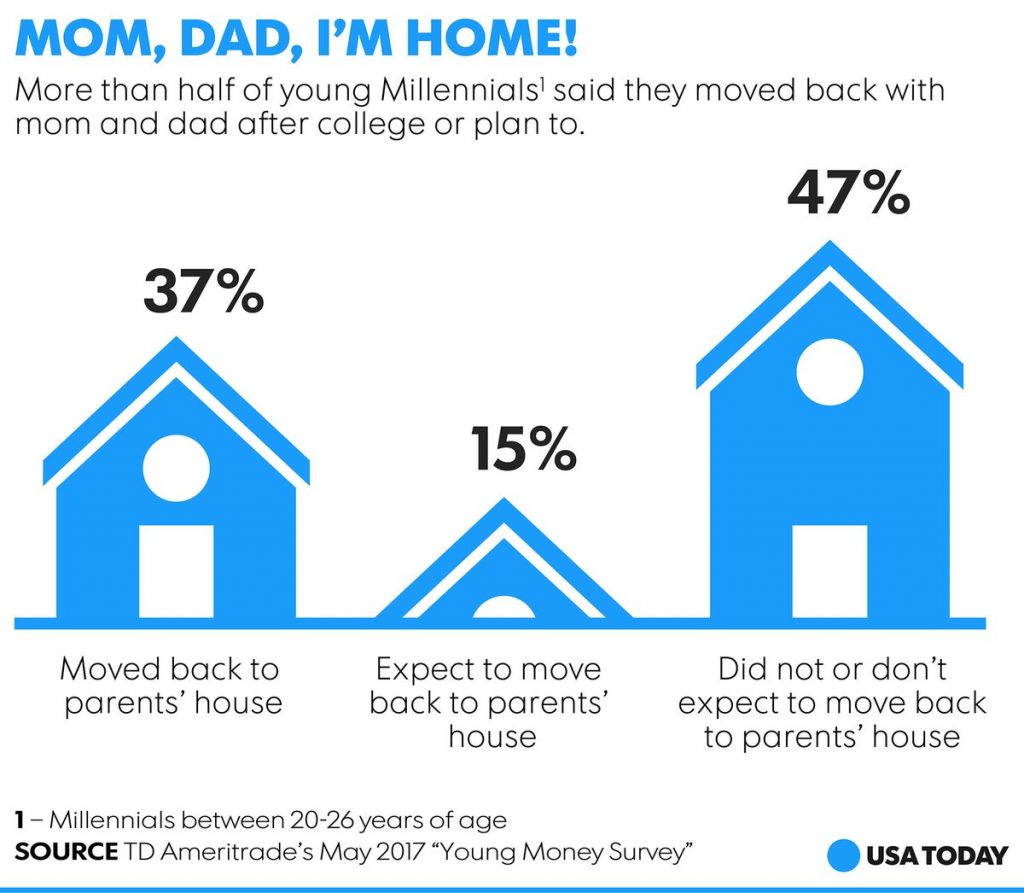

31% of Millenials moved home because of student loan debt.

Moving in with your parents is much more affordable but is also a stressor.

Dating, courtship, marriage and family planning were put on hold and the American Dream for many struggling with student loan debt never played out the way they thought it would.

Yet, we as HR professionals continued to push the benefits of saving for retirement because we didn’t have a better option to offer perks to our employees that actually mattered.

Educational debt is a multi-generational issue

There’s a cohort in the workforce that doesn’t get nearly enough attention because we think that the ‘older’ generation has it figured out.

They don’t.

In the United States, workers over the age of 50 are carrying 20% of student loan debt.

For this demographic, saving for near term retirement while carrying this much debt is a financially scary situation.

This extends retirement for many who are still in debt while they watch the debt free in their cohort retire on plan.

Even worse, many are in default. 37% of borrows over 65 y/o and ~30% of those 50-64 y/o are in DEFAULT.

The most ‘at risk’ demographic carrying debt are even older.

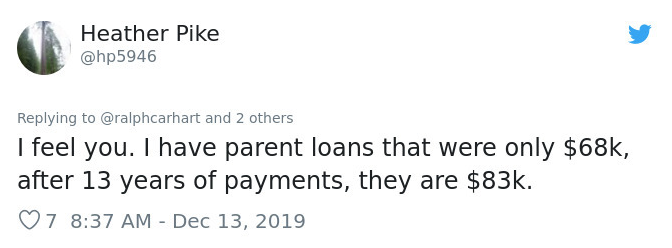

In the last few years those aged 60-70 years old have seen a 70% increase in educational related debt attributed to Parent PLUS loans.

Up to 15% of their Social Security payments are subject to garnishment to payback the loan which places a ton of pressure on retirees who are already living on fixed incomes.

Even with some government driven student loan forgiveness programs, the IRS treats forgiven loans as taxable income. The tax bill is often too high for the retirees to pay off so the government steps in an garnishes Social Security payments.

The struggle is real and it cuts a lot deeper than the ‘debt free’ realize or care to acknowledge.

How to Help Employees with Student Loan Debt

At the end of the day, it’s not your responsibility to assume 100% of your employee’s financial burden.

The quickest solution to debt is throwing money at the problem. Having more money to pay down debt makes it go away.

In a perfect world, with unlimited budget you could just pay your employees more money to help them pay down. There are two problems with my ‘perfect world’ solution:

- Even if you had the funds available to write a $20,000 check to each employee, how many of them would use ALL $20,000 to pay down their loans? Chances are that some folks would spend the money in a way that doesn’t have a financially impactful outcome.

- You don’t have unlimited budget. So, you need to get creative with how you maximize what is available to you.

In our current economic climate, most businesses can’t afford to increase payroll or cut life-changing spot bonuses.

There is a FREE option (link to /free section) that every employer can offer their team immediately: Financial Education

41% percent of U.S. adults gave themselves a grade of C, D, or F on their knowledge of personal finance; 80% agree they would benefit from advice; and less than 4% cited the workplace as the source where they acquired their knowledge of personal finance.

Offering financial education as Dominion suggests in addition to a flexible benefits that contribute to your employee’s financial wellbeing are critical to a healthy workforce.

Another option has been gaining traction over the last few years: Student Loan Benefits

80% of today’s modern workforce prefer to work for a company that offers a student loan repayment benefit because it 1) helps relieve financial hardship and 2) signals that the company care’s about their employee partners.

Not all Student Loan Benefit providers are created equal.

Here are the gotchas to look for:

- Some benefit companies are really just banks with the ‘benefit’ offering delivered as a thinly veiled outcome of getting the employee to refinance their loan. (thumbs down)

- Some benefit companies will require you to find more budget to deploy to fulfil the benefit of assisting with the loan paydown.

- Some benefit companies will require you to switch retirement providers creating a lot of unnecessary work for you.

Workforce Perks is the only Student Loan Benefit company that allows you to use your existing match budget to give your employees the choice for what % of the match should go toward 401k and what % should go toward their student loan payments.

A flexible matching program is the most inclusive financial wellness benefit on the market. (click to tweet)

Employees who are debt free can continue maxing out their retirement, while the indebted can focus more money towards their loan; saving money and reducing payback periods up to 50%.

Send an email to [email protected] to learn more.

Ps – if you haven’t read it yet, check out our post on recruitment and retention trends for the modern workforce here.