The world changed Q1 2020.

Social distancing, shelter in place, quarantine, furloughs are the new norm.

Overnight, millions out of work and our businesses retracted into cash protection mode.

HR professionals face a new reality.

Open job recs that piled on are now on hold, indefinitely.

Most of us spend our days talking with management about difficult staff reduction strategies then relaying his information to a shell shocked workforce.

People are scared.

As HR leaders, we need to be thinking about what happens post-Covid 19 Coronavirus.

What happens when hiring opens up again and the displaced workforce comes back to the office?

For now, the government has paused student loan interest. Mid 2021 Biden’s government passed The American Rescue Plan Act which provides tax-free student debt forgiveness until 2025.

The financial stressors of being out of work and under water in debt aren’t going away when the ‘new workforce’ comes back to work.

Understanding this cohort of Gen Y and Gen Z is the only way to deploy a future proofed, ‘recession ready’ recruitment and retention plan.

The New Workforce Dominated by Millennials and Gen-Z

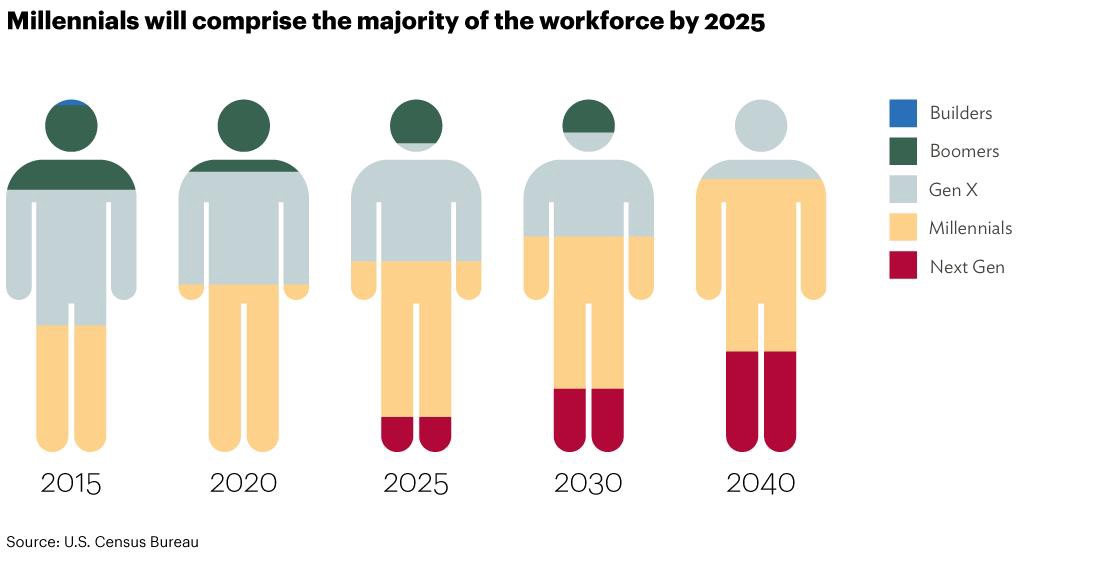

A staggering 10,000 Baby Boomers are reaching retirement age every single day.

In 2020, millennials (Gen Y), now aged between 23 and 38, make up 35% of the global workforce while Generation Z (22 and younger), will make up 2%.

When finally get back to work, more than half of the global workforce population will be made up by younger workers.

A lot has been written about Gen Z taking over the workforce in 2020 and what makes them tick.

These children of the 2008 Great Recession and 9/11 grew up in households that fostered the importance of financial security and independence.

You hired them. You’ve read their performance reviews.

You listen to them talk about their career goals and are quick to share feedback on their working environment.

But you’re likely not getting the full story.

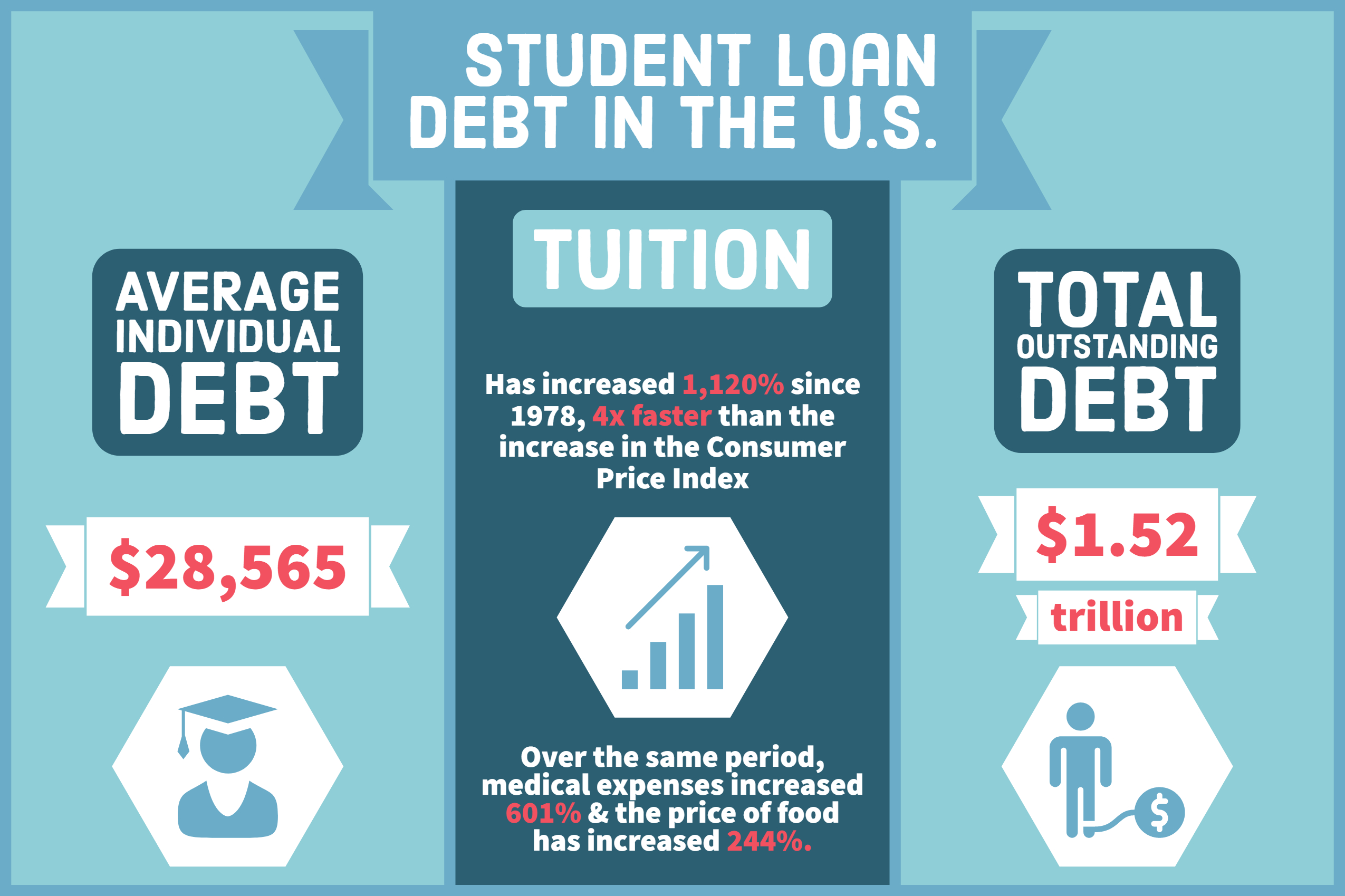

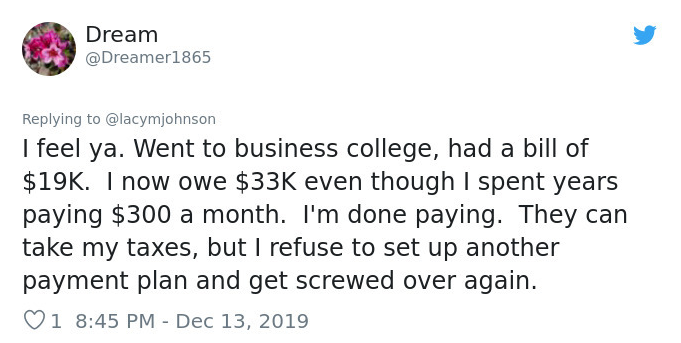

This entrepreneurial set of workers is shouldering a crippling amount of student loan debt.

45 million borrowers owe $1,600,000,000 in student loan debt compounded by interest rates. 7 out of 10 graduates had to borrow to afford school.

Those who managed to put off paying their loans back until better times are getting hit with a 99% rejection rate in public loan forgiveness.

These are the same people you see scurrying off to a conference room so they can privately answer an incoming phone call on a random Tuesday afternoon.

No, they’re not Face-timing a friend gossiping about going out last night.

They may be getting an embarrassing call at work from a debt collector or their bank warning of overdrawn checking accounts.

25% of adults admit to not paying all bills on time and 30%+ claim to have no savings.

These folks are living hand to mouth, paycheck to paycheck just to get by.

“Too much debt” is this Gen Y/Z’s #1 financial stressor with student loans as their second-most stressful form of debt.

This financial stress adds up and has a direct impact on your business.

The future of employee benefits

Your approach to creating a benefits plan attractive enough to recruit and retain college educated talent doesn’t require an increase in budget.

All you need is a different approach. Something truly beneficial to them.

A long term impact, with a short(er) term ROI.

Something to offset the stress of indebtedness for the next 10 years.

A Harvard Business Review study identifies that 60% of employees consider benefit packages as a key factor when deciding whether to accept a job offer.

Stock options, medical, dental, retirement, paid vacation, and wellness perks have become common place.

Table stakes.

Taking off Thursday and Friday for an extended weekend trip is no doubt a stress reliever. But reality sets in Monday morning.

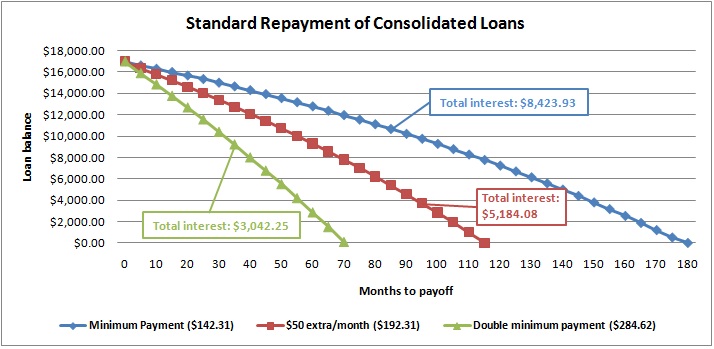

We’ve done the math. We’ve seen the look on someone’s face when we take them through the employer matched contribution projections for their student loan.

Payback period getting slashed by 50% from 10 years to 5. A light at the end of the tunnel.

The American Student Assistance survey reported that 76% of respondents said student loan repayment benefits would be a deciding or contributing factor to accepting a job offer.

The problem lies with the fact that too few employers are aware that this type of benefit exists.

In 2018 only 4% of employers offered Student loan benefits. In 2020, that number jumped to 8% and is expected to increase 4x in the next 12-24 months.

The Best Financial Wellness Employee Benefit in 2020

The line is blurring in the benefits world between ‘nice to have’ and essential.

Essential benefits are health and dental coverage, retirement plans, and paid time off.

The ‘nice to have’ benefit category includes flexible spending health accounts, flexible hours, working from home, tech budget, snacks, and more.

Adding additional benefits to meet the needs of your changing workforce doesn’t have to cost your business more money.

And, the fastest growing most in-demand company perk is a Student Loan Repayment Benefit which has grown 100% year over year for the past 2 years.

There aren’t many companies offering this perk. The providers who do offer a repayment benefit tend to come in a few different flavors which can be difficult to discern at first glance.

Before Workforce Perks, most student loan “benefit providers” fell into 2 categories:

- Most were banks, or better said innovative companies that were a front for the banks. The ‘benefit’ was a loan refinance (where’s the stat on why you don’t want to do this).

- The other ‘benefit providers’ required the employer to increase their benefit budget to fund the loan paydown. This was a big financial stressor for companies who were already matching a 401k.

- Workforce Perks is a simple add-on to your existing retirement benefit that costs a few bucks per month, per enrollee.

Don’t get fooled by ‘other benefit providers’ into wasting your time revamping your entire benefits package to find budget for this perk.

We’ve seen some other providers suggesting that financially strapped companies should take away paid vacation time as a way to fund the student loan benefit. 🤦♂️

This is completely unnecessary with Workforce Perks flexible matching benefit.

A flexible match plan is the cheapest benefit option

With flexible matching, you take your existing match dollars and give your employees the choice as to what % of the match dollars should go to 401k vs. Student Loan repayment.

For example, let’s say you match contributions up to 4% with immediate vesting… dollar for dollar up to 3% and 1/2% for each whole percent to the full 4% (9% total).

Jim makes $60,000 base per year. He elects to max out his match and allocates 5% of his salary ($3,000) to his 401k. Your company matches Jim’s contribution at 4% ($2,400).

Jim elects to shift his investment supported by your generous matching dollars. It looks like this…

$250 – Student loan paydown

$200 – 401k contribution

If Jim continues to make his normal out of pocket monthly student loan payment of $300 + diverting the match, he’s on pace to pay off his loan in 5 years.

You just saved Jim $4,000 in principal + interest and cut his payback period by 5 years!

Working with a company like Workforce Perks takes the headache out of having to verify, authorize, and monitor the loan payments because our platform does it all for you.

No need to switch payroll providers or retirement plan administration/brokerage. Simple.

Drop us an email to [email protected] to learn more about how to add a Student Loan Benefit to your existing financial wellness perks or request a demo below.

How to Help Employees with Student Loan Debt - Workforce Perks

[…] “Too much debt” is this GenY/Z’s #1 financial stressor with student loans as their second-most stressful form of debt. […]

Pre-tax Student Loan Benefit Contributions - Workforce Perks

[…] The Student Loan Benefit was already the hottest employee requested perk for 2020. […]